Active income vs passive income

Earnings can be divided into two different categories: active income and passive income. Each of these categories has its own characteristics and results in the way people make money.

Definition of active income

Active income is money that is earned through direct, sustained effort or labor. Active income is also known as “working income”. This results in the exchange of one’s time and expertise for financial compensation. Common examples of active income include the following:

- Salary/Wages: Your earnings from a job in which you are paid on an ongoing basis for the work you do is called your salary wages.

- Hourly Pay: Compensation determined based on the number of hours performed is called hourly wage.

- Self-Employment Income: Self-employment income refers to money earned through a company or freelance job in which your own efforts are directly related to the money you earn.

- Commission-Based Earnings: Earnings that depend on sales or performance objectives are called commission-based earnings.

Securing active revenue requires constant labor and effort. Generally speaking, if you stop working, your income will do the same. A large number of individuals depend on their active income to meet their daily costs.

Definition of passive income

Conversely, passive income is money that is created with little or no direct input or effort on the part of the individual. Income that is derived from assets or investments that require less constant care is called passive income. Take a look at the following examples of passive income:

- Rental Income: The income earned from renting out property or immovable property is called rental income.

- Dividend Income: Payments earned as a result of ownership of stock or shares in a corporation are called dividend income.

- Interest Income: Money generated by lending money or investing in interest bearing assets is called interest income.

- Royalties: Royalties are a type of income received from intellectual property, which includes things like books, music, and patents.

Because they continue to make money even when you’re not actively working, passive income streams have the ability to deliver financial security and flexibility even when you’re not actively working. On the other hand, creating and maintaining passive income streams often requires an initial outlay of time and financial expenditure.

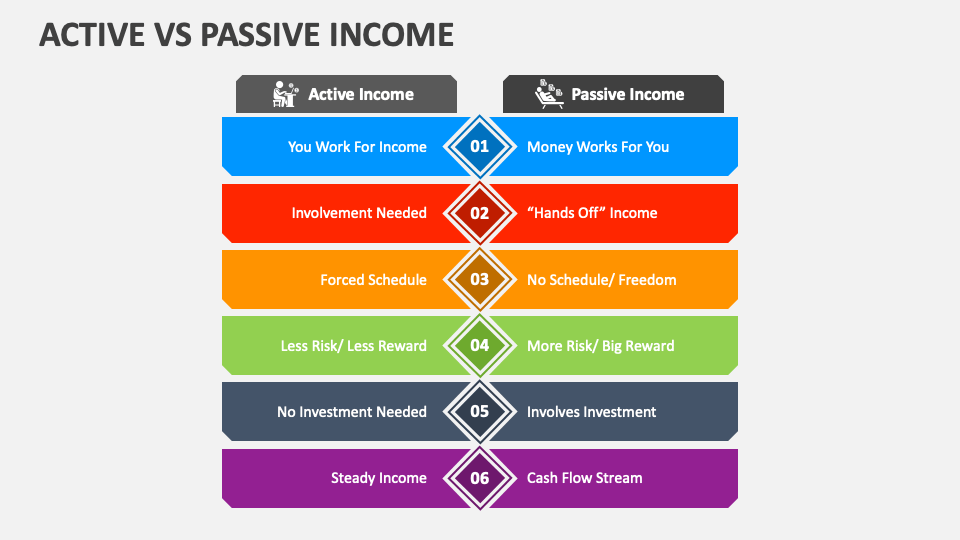

The difference between active and passive income

- Participation:

- Active Income: This type of income requires endless time and effort.

- Passive Income: Passive income requires less direct engagement on a day-to-day basis once it is established.

- Sensitivity due to time:

- Active Income: When you stop working, your active income will end.

- Passive Income:Passive income is income that continues to be earned even when no labor is done.

- Ability to grow:

- Active Income: Active income is often limited by the amount of hours a person is able to work.

- Passive Income: Passive income comes with the possibility of scalability as it is not directly related to the time you spend on it.

- Effort required to create:

- Active Income: Active income requires immediate effort.

- Passive Income: Earning passive income requires initial work and commitment, but it has the potential to reap rewards over time.

- Risk

- Active Income: Active income is relatively consistent but sensitive to variations in the job market.

- Passive Income: Passive income may be subject to market and investment risks.

Diversification is a strategy that many financial advisors recommend. This strategy involves a mix of active and passive income sources to develop a financial portfolio that is more robust and balanced.

FAQs:

Question: Can you provide examples of active income?

Answer: Examples of active income include salaries, hourly wages, self-employment income, commission-based earnings, and other forms of compensation tied to direct personal effort.

Question: What are some examples of passive income sources?

Answer: Passive income sources include rental income, dividends from stocks, interest from investments, royalties from creative works and income generated from automated business ventures.

Question: Are both active and passive income streams possible?

Answer: Yes, many individuals try to diversify their income by combining both active and passive sources to achieve financial stability and flexibility.

Question: Which income type is more time sensitive?

Answer: Active income is time sensitive and stops when you stop working. Conversely, passive income can continue even when you are not actively working.

Q: Are there risks associated with passive income?

Answer: Yes, passive income sources can have risks, such as market fluctuations, investment risks, or initial capital requirements. It is important to do thorough research before pursuing passive income opportunities.

Question: Do passive income streams require upfront effort?

Answer: Yes, many passive income streams require upfront effort, time, or investment before they can truly become passive. Creation and management of these sources often involves initial setup and ongoing maintenance.

Question: Which type of income is more scalable?

Answer: Passive income has the potential for scalability because it is not directly tied to the number of hours worked. On the other hand, active income is often limited by the time a person can devote to work.

Question: Can passive income completely replace active income?

Answer: In some cases, individuals work towards creating enough passive income to supplement or replace their active income. However, achieving this often requires significant planning, effort, and time.

Question: How can one start creating a passive income source?

Answer: Strategies for building passive income include investing in stocks or real estate, creating and selling digital products, starting a blog or YouTube channel, and participating in affiliate marketing. It is important to choose methods that suit individual skills and interests.