Introduction

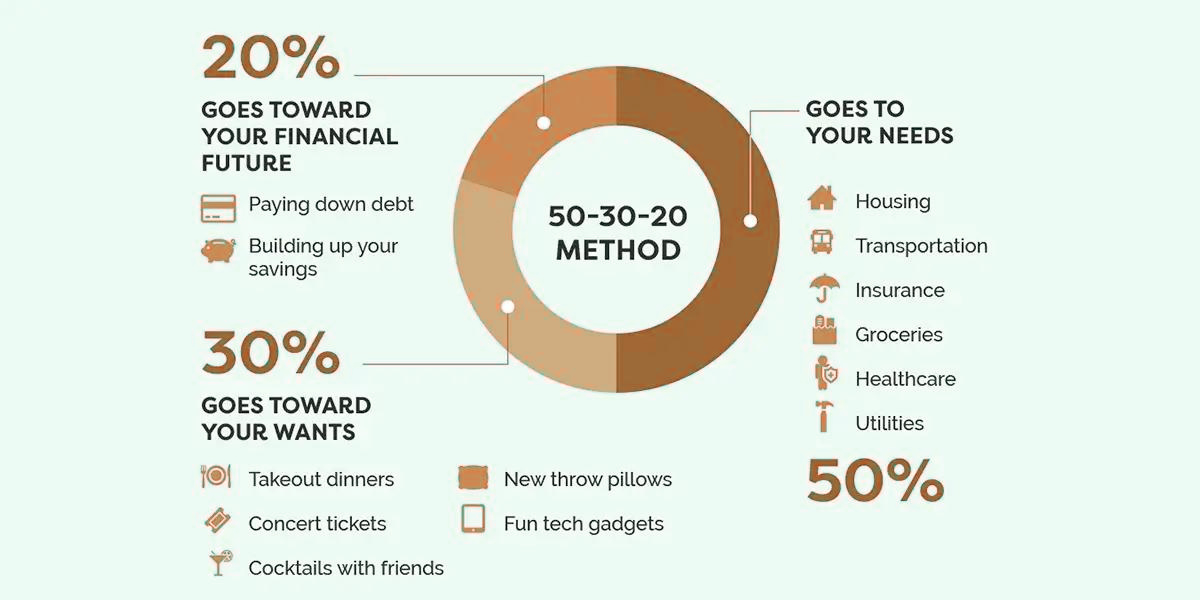

Welcome to a financial transformation! If you’ve ever felt overwhelmed by money management, you’re not alone. In this blog post, we’re going to unravel the financial mysteries and give you a clear path to success. Enter the 50-30-20 rule—a simple yet powerful budgeting strategy that can change your financial life. This rule can help you effortlessly manage your needs, enjoy your wants, and save for your dreams. If you’re ready to achieve financial stability, build wealth, and take control of your finances, read on.

Understanding the 50-30-20 Rule

The Basics: What is the 50-30-20 rule?

- A simple budgeting strategy

- Allocating your income wisely

The Logic behind It: Why does it work?

- Balancing essential expenses with discretionary spending

- Focusing on savings and debt reduction

The Simplicity Factor: Why it’s easy to follow

- No complicated formulas or spreadsheets

- Perfect for those new to budgeting

The 50% – Covering Your Needs

Prioritizing Your Needs: Which bills should come first?

- Housing and utilities

- Groceries and healthcare

- Transportation and insurance

Creating a Needs Budget: A step-by-step guide

- Calculating your essential expenses

- Setting realistic spending limits

Staying Frugal: Tips for reducing essential expenses

- Cutting energy costs

- Meal planning and smart shopping

- Comparing insurance rates

The 30% – Enjoying Your Wants

What Are Wants? Distinguishing between needs and wants

- Dining out and entertainment

- Travel and hobbies

- Non-essential purchases

Managing Your Wants: Strategies for staying within budget

- Setting spending limits

- Prioritizing your favorite indulgences

- Finding budget-friendly alternatives

Embracing Enjoyment: Balancing fun with financial responsibility

- Allocating for leisure without guilt

- Cultivating smart spending habits

- Avoiding impulse purchases

The 20% – Building Your Savings

Savings Strategies: Where to put your money

- Emergency funds

- Retirement accounts

- Investment opportunities

Emergency Fund Essentials: Why you need one

- Preparing for life’s unexpected curveballs

- Peace of mind in financial emergencies

Debt Reduction: Paying off loans and credit cards

- High-interest debt vs. low-interest debt

- Strategies for tackling debt efficiently

- Achieving a debt-free future

Implementing the 50-30-20 Rule in Your Life

- Assessing your current financial situation

- Setting up a 50-30-20 budget

- Tracking your expenses

The Advantages of the 50-30-20 Rule

Simplicity and Ease of Use

- No need for complex financial tools

- Easier to maintain and adjust

Flexibility for Various Income Levels

- Scaling the rule for high and low incomes

- Adapting to changing financial circumstances

Adaptability to Your Financial Goals

- Accommodating specific objectives

- Scaling your savings for long-term goals

Overcoming Common Challenges

Dealing with Irregular Income

- Budgeting for inconsistent paychecks

- Creating a buffer for lean months

Managing Unexpected Expenses

- Creating a dedicated emergency fund

- Avoiding debt in the face of surprises

Staying Disciplined

- Establishing a budgeting routine

- Motivating yourself to stick to the rule

The Long-Term Benefits

Buying a Home

- Saving for a down payment

- Managing mortgage costs

Saving for Retirement

- The power of compound interest

- Achieving financial independence

Achieving Financial Freedom

- Creating financial security

- Pursuing your dreams with confidence

Tailoring the 50-30-20 Rule to Your Goals

Customizing the Rule for Your Needs

- Adjusting percentages for unique situations

- Making room for special expenses

Setting Specific Financial Objectives

- Defining your short-term and long-term goals

- Creating a roadmap for success

Making the Rule Work for You

- Enjoying the flexibility of the rule

- Finding fulfillment in financial control

Conclusion

The 50-30-20 rule isn’t just a budgeting method; it’s your ticket to financial freedom and success. By allocating your income to needs, wants, and savings, you’re not just managing your money; you’re crafting a brighter future. Whether you want to buy a home, save for retirement, or simply enjoy financial peace of mind, this rule offers the guidance you need. It’s simple, it’s effective, and it’s for everyone. So, start your journey today and see how the 50-30-20 rule can transform your financial life. Say goodbye to financial stress and hello to financial well-being!

FAQs:

- What is the 50-30-20 rule in finance?

- A budgeting guideline allocating 50% to needs, 30% to wants, and 20% to savings.

- How do I start implementing the 50-30-20 rule?

- Begin by listing your monthly income, categorize expenses, and allocate percentages accordingly.

- Can I customize the percentages based on my situation?

- Yes, the rule is flexible; you can adjust percentages to suit your financial goals and circumstances.

- What expenses fall under the 50% for needs category?

- Essential bills like rent or mortgage, utilities, groceries, and insurance are typically included.

- What constitutes the 30% for wants?

- Non-essential spending like dining out, entertainment, and leisure activities fall into this category.

- How can I optimize the 20% allocated to savings?

- Divide the 20% between emergency funds, retirement savings, and other financial goals.

- Is it possible to follow the 50-30-20 rule on a variable income?

- Yes, adjust your budget each month based on your income, prioritizing needs, wants, and savings accordingly.

- Can the 50-30-20 rule be applied for long-term financial planning?

- Absolutely, it provides a foundation for sustainable financial habits and helps achieve long-term goals.

- What if I have debt? How does the rule address this?

- Use a portion of the 20% for savings to accelerate debt repayment, ensuring a balanced approach to financial health.

- How often should I reassess and adjust my budget under this rule?

- Regularly review your budget, especially when your financial situation changes, to ensure it stays aligned with your goals.